Spend more time freelancing and less time on billing. Use our free invoice template to get paid faster and free up your time to focus on what you love: freelancing.

You became a freelancer because you want to work independently and hassle-free. Not because you want to process invoices. W hether that be for writing content, design and development work, or other creative projects. Our free invoice template is here to shortcut the job of generating free invoices.

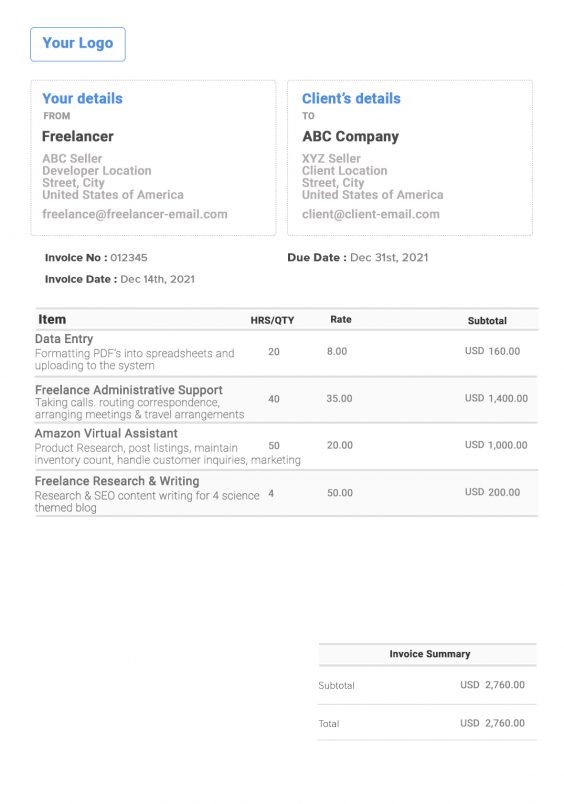

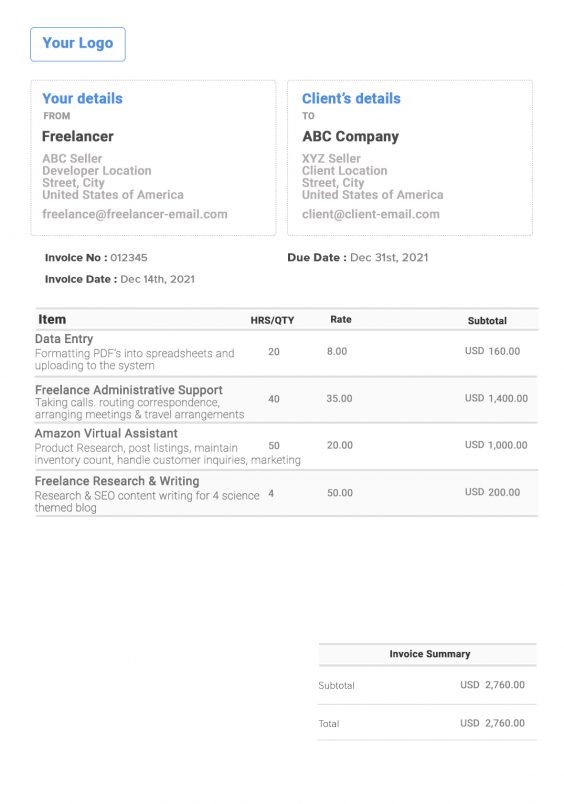

| ✔ Unique invoice number |

| ✔ A payment due date |

| ✔ The total price for the project |

| ✔ Your name, business name, and contact details |

| ✔ The client’s business name and contact details |

| ✔ Details of any discounts, on a separate line. |

| ✔ The invoice date, which is the date when you send the invoice |

| ✔ Payment methods you’ll accept, such as check, bank transfer, credit card, or other payment details. |

| ✔ Extra payment terms, late payment fees, early payment discount, or check processing fees |

| ✔ List of services provided. Each task on a separate line, such as “Data Entry”, “Project Management” or “Email Marketing” & add the quantity or the no. of hours, & the total cost for each task. |

Being a freelancer means carrying out different tasks, from content-writing to graphic design or virtual assistance. Your clients might not realize how much goes into your work, so make sure to break down your freelance services, so they understand what exactly they are paying for.

For example, you are responsible to set up an e-commerce website on WordPress for an online store. The type of task would be “WordPress website development” and the tasks themselves would be “Setting up domain & hosting”, “adding products” & “customizing theme & website layout”.

It’s a good idea to use a freelance invoice generator and create a list of your most commonly-used services, so you can copy and paste them into your invoice.

| ✔ Copy Writing & Content |

| ✔ Virtual Assistance |

| ✔ Video Editing & Production |

| ✔ Graphic Designing |

| ✔ Amazon Services |

| ✔ Digital Marketing Services |

| ✔ Web Design & Development |

| ✔ Data Analyzing & Visualization |

| ✔ Consulting Services |

| ✔ Social Media Management & Marketing |

| ✔ WordPress Management & Development |

| ✔ Project Management |

| ✔ Data Entry & Admin Support |

As a freelancer, an invoice can get you paid for all the unique services you provide. Other benefits include:

✔ Find income information when it’s time to file taxes.

✔ Keep track of the different services that you offer.

✔ Stay in control of your client accounts.

✔ Always know when payments are due or overdue.

✔ Make it simple to follow up on late payments.

✔ Monitor your freelance business’ growth.

✔ Keep book-keeping in-house for longer.

✔ Show tax authorities that you are organized and reliable.

![]() How to reclaim your VAT" width="350" height="270" />

How to reclaim your VAT" width="350" height="270" />

You may be a social media freelancer or a digital marketer, no matter the niche, your invoice should be sent to the client at the right time for timely payments. The best time to invoice depends on the project.

Some companies have a fixed day of the month when they make their international payments, so send in your invoice a few days in advance.

Freelancing comes easy, but invoicing for freelance services leaves you stumped. Here’s a list of freelance invoicing best practices to make things easier:

✔Accept as many payment methods as possible, especially electronic transactions.

✔Include multiple ways for your client to contact you, in case they have a question.

✔Review your contract to check that you’ve fulfilled all the terms and that your invoice details match what you agreed with the client.

✔Use a free web development invoice template to make your invoice look professional and easy to read.

✔List special costs like late fees, and taxes like sales tax, separately.

✔Keep a copy of every invoice for your records, so that you can track when payment is due.

✔Follow up on client payment. Make sure to send reminders promptly if anyone misses a payment.