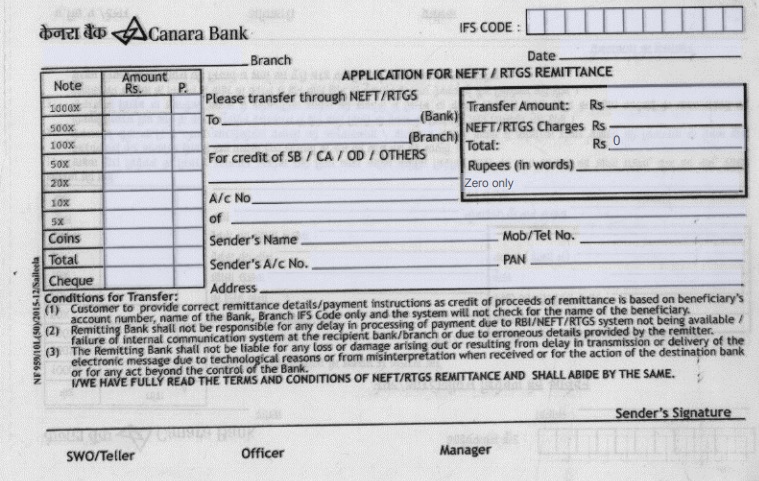

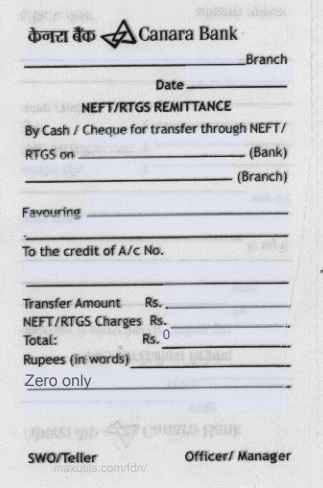

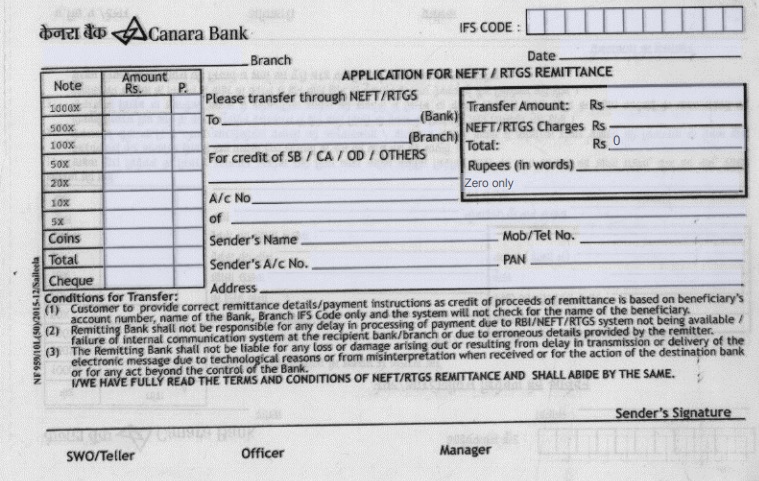

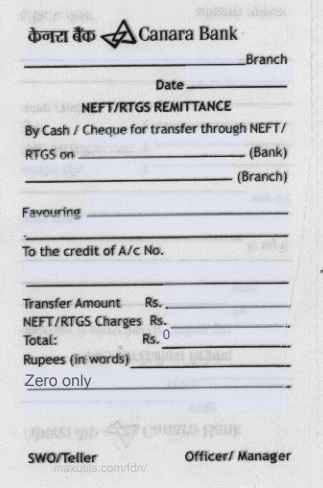

Canara Bank NEFT/RTGS Application Form PDF Download

There are various methods that can be used to transfer money from one bank account to another. Keeping the Indian Banking system in context we have a lot of ways! There are IMPS, UPI, etc. which can transfer money quickly. But the problem with them is the maximum limit is less.

And this is where we come across NEFT and RTGS. If you want to transfer money in lakhs then you should use these. Here NEFT is an acronym for National Electronic Funds Transfer. And RTGS is an acronym for Real-Time Gross Settlement. You can download the Canara Bank NEFT Form and the RTGS Form from here in PDF Format.

You can download the Canara Bank NEFT and RTGS Application form by visiting the official website of the bank. The application form can also be downloaded in PDF format by using the link provided at the end of this article. Once you have downloaded the application form you can take a printout of it.

When Should You Use NEFT?

If you want to transfer money of a value less than Rs. 2,00,000 then you should use the national electronic fund’s transfer. There is no minimum value of NEFT, the maximum is Rs. 10,00,000.

When Should You Use RTGS?

If the value of the transaction is more than Rs. 2,00,000 to Rs. 10,00,000 then RTGS will be the right choice for you to carry out the fund’s transfer.

Canara Bank NEFT Transaction Charges

| Transaction Amount | NEFT Charges |

| Up to Rs. 10,000 | Rs. 2.25 + GST |

| Rs. 10,001 to Rs. 1,00,000 | Rs. 4.75 + GST |

| Rs. 1,00,000 to Rs. 2,00,000 | Rs. 14.75 + GST |

| Above Rs. 2,00,000 | Rs. 24.75 + GST |

Canara Bank RTGS Transaction Charges

| Transaction Amount | RTGS Charges |

| Rs. 2,00,000 to Rs. 5,00,000 | Rs. 24.50 + GST |

| Above Rs. 5,00,000 | Rs. 49.50 + GST |

When You Have to Pay NEFT and RTGS Charges?

The bank will charge you for the NEFT and RTGS transaction charges you do from your home branch. Not only from the home branch you will be charged whenever you use any of their branches to make the NEFT and RTGS transactions.

How to Save NEFT and RTGS Transaction Charges?

You have a chance to save the transaction charges by not paying them. Canara Bank will not charge you anything for the NEFT and RTGS transactions you do with the digital channels. When I say digital channels I am talking about the internet banking portal and official mobile banking applications of the bank.

Download Link of Canara Bank NEFT or RTGS Form PDF

You can download the application form in PDF format by following this download link.

How to Fill Canara Bank NEFT or RTGS Application Form?

You have to fill in the below-mentioned details in the application form once. There are two sections in the application form. You have to enter the details of the beneficiary account on the left side of the form. And the details of the person who is initiating the fund transfer’s details should be filled in on the right side of the form.

You have to fill in the below-mentioned details in the application form once. There are two sections in the application form. You have to enter the details of the beneficiary account on the left side of the form. And the details of the person who is initiating the fund transfer’s details should be filled in on the right side of the form.

- Enter your Canara Bank branch’s name. Mention your home branch if you are initiating the transfer from your home branch.

- Mention the date on which you are filling out the application form.

- Select between RTGS or NEFT, you can use the same application form for both of them.

- Select how you want to pay the money. (By Cash or by Cheque)

- Mention the details of the beneficiary’s bank and branch.

- Enter the name of the beneficiary for whose favor you are transferring the money.

- Now enter the amount you want to transfer in words and in numbers.

- You have to fill the details of the person who is initiating the NEFT or RTGS transfer in the left section of the application form.

- Once you have filled in the details like the Sender’s name, account number, address, mobile number, and PAN Card number. Make your signature on the left bottom side of the application form.

Conclusion

This is how you can download Canara Bank NEFT Application Form PDF and Canara Bank RTGS Application Form in PDF format. I have also explained how you have to fill out the form. And I hope you are clear with all the information which is mentioned in this article.

You have to fill in the below-mentioned details in the application form once. There are two sections in the application form. You have to enter the details of the beneficiary account on the left side of the form. And the details of the person who is initiating the fund transfer’s details should be filled in on the right side of the form.

You have to fill in the below-mentioned details in the application form once. There are two sections in the application form. You have to enter the details of the beneficiary account on the left side of the form. And the details of the person who is initiating the fund transfer’s details should be filled in on the right side of the form.